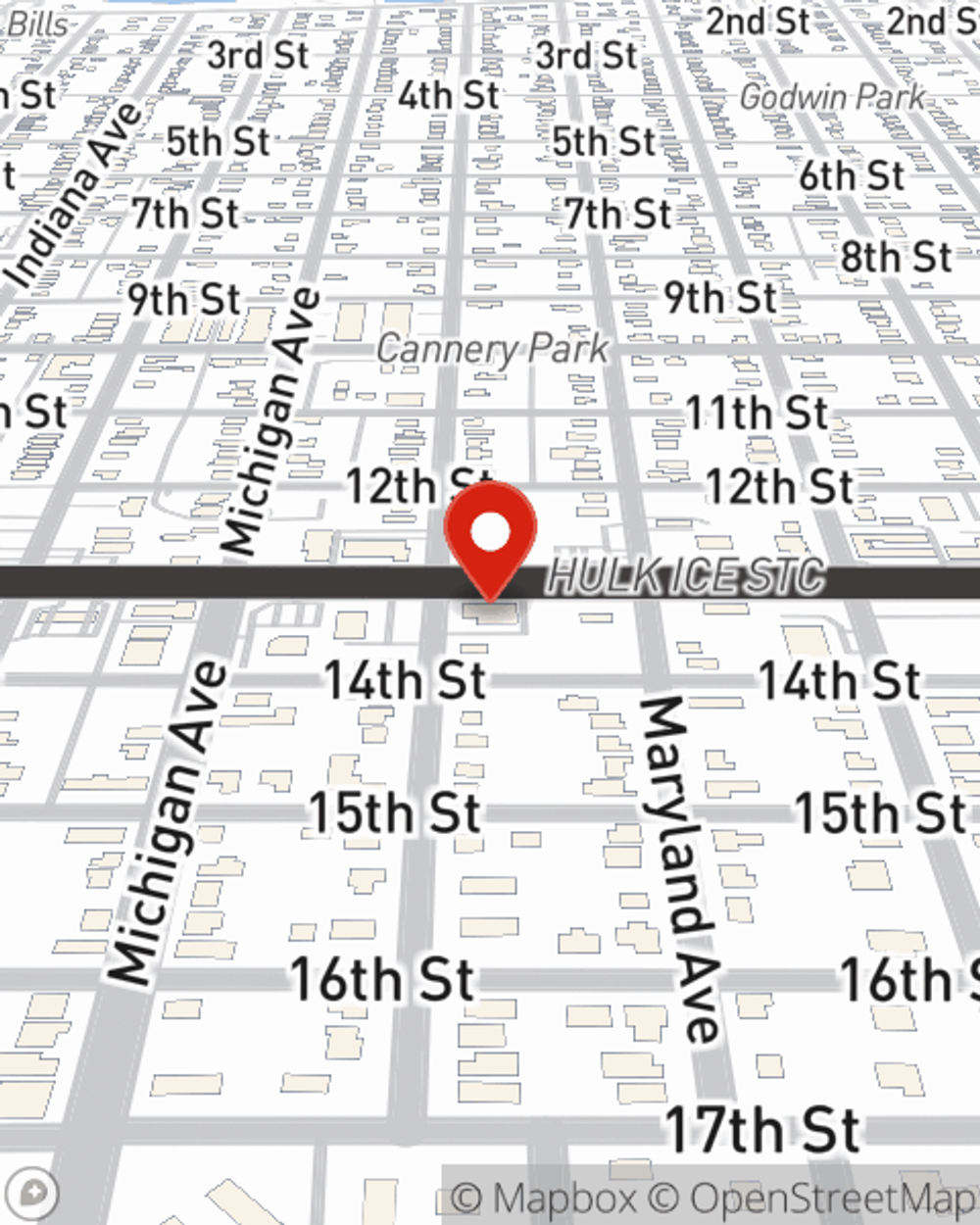

Life Insurance in and around Saint Cloud

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

It can be what keeps you going every day to take care of the people you love, which may include finding the right Life insurance coverage. With a policy from State Farm, you can help ensure that the people you love can keep paying for your home and/or pay for college as they grieve your loss.

Protection for those you care about

Now is a good time to think about Life insurance

Saint Cloud Chooses Life Insurance From State Farm

Fortunately, State Farm offers several coverage options that can be adjusted to correspond with the needs of those most important to you and their unique situation. Agent Ann Werning has the deep commitment and service you're looking for to help you opt for coverage which can help your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to explore what the State Farm brand can do for you? Get in touch with State Farm Agent Ann Werning today.

Have More Questions About Life Insurance?

Call Ann at (407) 593-1080 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

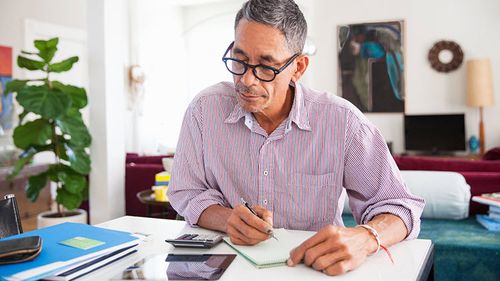

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Ann Werning

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.